- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Is Warner Bros Discovery Stock a Buy Amid Reports of a Potential Paramount Bid?

When corporate giants circle the same prize, a bidding war can ignite, driving valuations sky-high and rewriting industry maps. In Hollywood, where content is king and streaming empires are built on global reach, such clashes don’t just shuffle ownership but can redefine the very shape of the entertainment landscape.

The latest spark? A Wall Street Journal report that Paramount Skydance (PSKY) — fresh off its takeover of Paramount — is preparing a majority-cash bid for Warner Bros. Discovery (WBD). The news sent WBD stock soaring over 50% in just three trading days as investors quickly priced in the possibility of a Hollywood showdown.

A Paramount-WBD tie-up would instantly create a streaming giant with nearly 200 million subscribers and $20 billion in annual ad revenue, putting pressure on rivals from Disney (DIS) to Amazon (AMZN). Yet, with WBD’ crown-jewel franchises on the table and deep-pocketed competitors like Apple (AAPL) , Comcast (CMCSA), and Netflix (NFLX) rumored to be circling, the stakes couldn’t be higher.

So, is WBD stock a buy amid the brewing battle?

About Warner Bros Discovery Stock

Born from a high-stakes 2022 merger, New York-based Warner Bros. Discovery fused Hollywood grandeur with lifestyle grit, melding CNN, HBO, and TNT with TLC, HGTV, and Discovery Channel. Now a global content titan broadcasting in 50 languages across more than 220 nations, WBD curates culture at scale. Commanding a $45.2 billion market capitalization, the company straddles prestige and populism, leveraging deep IP arsenals and cable dominance to navigate streaming wars and media upheaval.

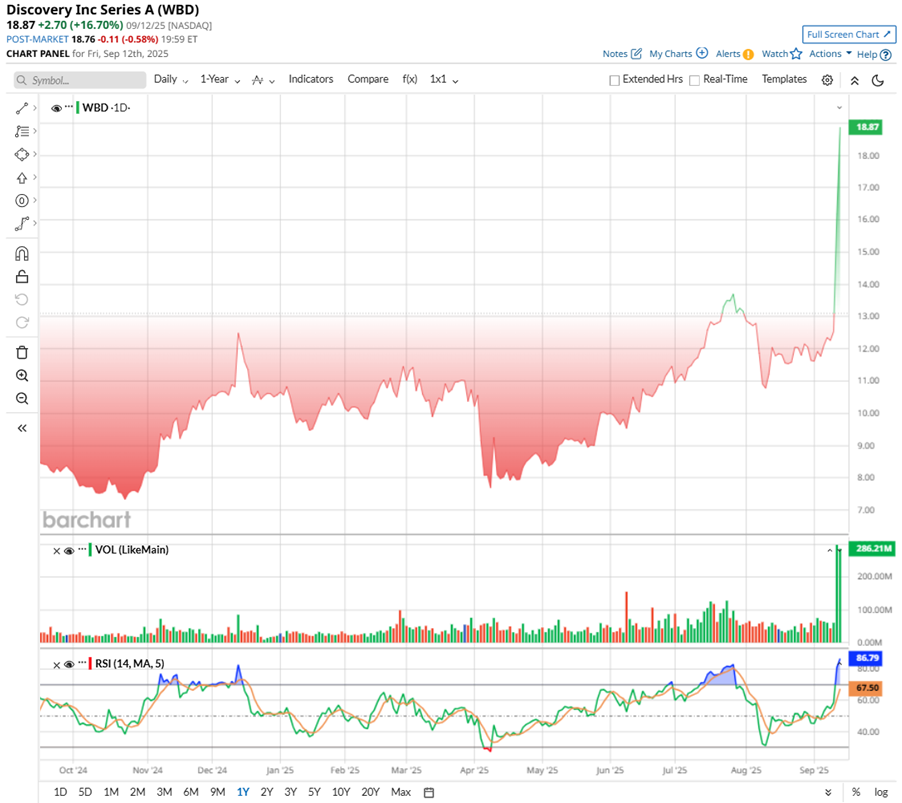

Warner Bros. Discovery may carry the aura of a heavyweight in media, but WBD stock has been through a slugfest this year. After plunging to a year-to-date (YTD) low of $7.52 in April, shares have staged a ferocious comeback, up 140% from the trough.

The knockout punch came this month, with WBD stock ripping nearly 29% on Sept. 11, then another 17% the next day, hitting a high of $19.59 on Sept. 15 after reports of the potential Paramount Skydance bid. The momentum has pushed WBD stock to a 113% gain over the past year, a 70% rally in three months, and an eye-popping 43% surge in just five trading sessions.

Volume has spiked, and the 14-day RSI has rocketed into the mid-80s — firmly in overbought territory. Although technical indicators hint at stretched levels, the ongoing M&A speculation continues to drive momentum, making the trajectory less about sustained stability and more about the next decisive catalyst.

From a valuation standpoint, Warner Bros. Discovery looks like a paradox. The stock trades at just 1.2 times sales, a discount shaped by Wall Street’s doubts over its aging cable assets. But the recent rally, sparked by news of the possible bid, suddenly threw a spotlight on WBD — suggesting the market might have been sleeping on the stock. While structural challenges remain, the market’s response suggests that WBD stock’s discounted valuation may increasingly be viewed as latent upside, should consolidation materialize.

Warner Bros. Discovery’s Q2 Earnings Snapshot

Warner Bros. Discovery’s second-quarter earnings report, released on Aug. 7, was a mix of progress and pressure — the kind of story Hollywood itself might script. On the surface, the headline was clear. Revenue landed at $9.8 billion, up just 1% year-over-year (YOY) but shy of expectations. Plus, the company flipped from last year’s bruising loss of -$4.07 per share to a surprising per-share profit of $0.63, trouncing Wall Street’s forecast of a -$0.16 loss.

Beneath that headline, however, the picture was more uneven. Advertising revenue slid 10% YOY, weighed down by fading linear TV audiences. Distribution stayed flat, caught between cord-cutting at home and subscriber gains abroad. On the brighter side, content revenues rose 16% thanks to stronger theatrical releases.

Segment performance was a mixed bag. The streaming segment surprised, with subscribers rising to 125.7 million, revenues climbing 9% to $2.8 billion, and the segment turning a profit of $293 million versus a $107 million loss a year ago. But ARPU slipped — domestic fell to $11.16 and international to $3.85, reflecting ad-supported distribution. Streaming’s Global Linear Networks lagged, with revenues down 9% to $4.8 billion, distribution off 7%, and advertising plunging 12%.

Studios stole the spotlight — revenues jumped 55% YOY to $3.8 billion, profits soared to $863 million, and content revenues surged 61% to $3.6 billion.

Financial discipline also played its part. WBD reduced gross debt by $2.7 billion in the quarter, bringing its load to $35.6 billion, while maintaining $4.9 billion in cash reserves.

Management is guiding for at least 150 million streaming subscribers by 2026 and targets $1.3 billion in streaming profit this year, alongside $3 billion in EBITDA from its studios. Analysts, however, remain cautious. They anticipate fiscal 2025 profits easing back to $0.33 per share before flattening next year.

What Do Analysts Expect for WBD Stock?

Analysts wasted no time weighing in after reports surfaced that Paramount Skydance was eyeing Warner Bros. Discovery. The chorus carried both excitement and caution.

Bloomberg Intelligence analyst Geetha Ranganathan said the potential tie-up “makes tons of both strategic and economic sense.” The analyst noted that both companies remain sub-scale in streaming, but together they would command nearly 200 million subscribers. That would be enough to rank among the world’s top five players. For context, Netflix boasts more than 300 million subscribers, while Disney+ and Hulu combined have 183 million.

Scale is not the only factor. The combined entity would generate about $20 billion in TV ad revenue, with analysts projecting $3 billion to $5 billion in annual merger synergies. “This absolutely raises the stakes for everybody,” Ranganathan said, pointing to Warner’s marquee brands alongside HBO Max’s premium slate. She called it a “once-in-a-lifetime opportunity” that could spark a Hollywood bidding war.

MoffettNathanson analyst Robert Fishman echoed that sentiment, writing that WBD now appears “formally in play,” with timing that suggests Skydance had long embedded the deal into its consolidation strategy. KeyBanc analyst Brandon Nispel labeled the news a “clear positive” but stressed that any offer would need to exceed management’s post-spin breakup valuation. CFRA's Ken Leon, meanwhile, pointed to the elephant in the room — WBD’s $35.6 billion debt pile, coupled with potential regulatory and union resistance.

Adding another wrinkle, Warner Bros. Discovery is already set to split into two companies by mid-2026. That, Ranganathan argues, explains Paramount Skydance's timing and urgency — “Paramount wants to still get Warner Bros. before it splits, because that will obviously drive up the value, especially of the studio and streaming business.”

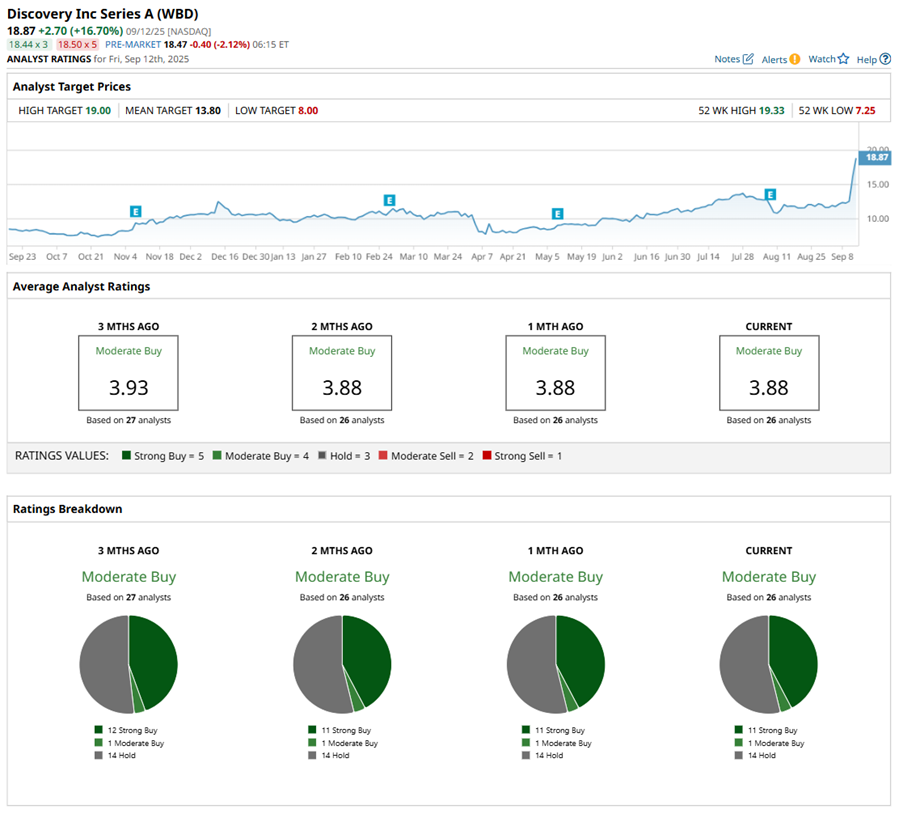

Warner Bros. Discovery has hit a few bumps lately, with a shaky Q2 performance putting some pressure on its story. Still, Wall Street isn’t ready to write it off. Overall, analysts remain cautiously optimistic on WBD stock, giving shares a “Moderate Buy” rating. Of the 26 analysts offering recommendations, 10 have a “Strong Buy,” one suggests a “Moderate Buy,” and the remaining 15 play it safe with a “Hold.”

Trading above its $13.80 average analyst price target and just 6% shy of the Street-high target of $19, WBD stock seems to be whispering that its story is far from over. Investors are watching, hopeful that the next chapter could finally turn the tide in its favor.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.