- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

PONY vs. TSLA: Which Is the Better Robotaxi Stock to Buy in August 2025?

/EV%20charging%202%20by%20UniqueMotionGraphics%20via%20iStock.jpg)

The future of mobility is going to be autonomous. While a 2023 study by consulting giant McKinsey had projected that revenues in the autonomous driving sector could reach between $300 to $400 billion by 2035, recent reports by Fortune Business Insights and Precedence Research expect the robotaxi market in particular to reach $118.61 billion by 2031 and $188.91 billion by 2034, respectively.

Until a few years ago, Elon Musk-led Tesla (TSLA) was touted as the natural leader of the lucrative robotaxi industry. However, as is the case with all things related to Musk, nothing related to the mercurial boss of Tesla is without headlines. And that has exactly been the case in recent years, particularly with intense competitive pressure in the realm of autonomous driving for Tesla. While Alphabet-led (GOOG) (GOOGL) Waymo has been putting pressure on the home front, Musk seems more worried about competition from China. In a recent earnings call, he said: “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China, depending on what kind of tariffs or trade barriers are established. Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other car companies in the world.”

Now the usual suspects in the form of larger players like BYD (BYDDF), XPeng (XPEV) and Xiaomi may have garnered much attention, but a relatively smaller company based out of Guangzhou, China, called Pony AI (PONY) can cause further heartburn for Tesla.

But does Pony have the potential in the long run to give Tesla a run for its money, or in this battle of David vs Goliath, it may not be such a fairytale ending for the much smaller peer? Let's take a closer look.

Pony AI (PONY)

Founded in 2016, Pony.ai is a global leader in autonomous mobility solutions, specializing in full-stack self-driving technologies for robotaxis, autonomous trucks, and personally owned vehicles. Publicly listed in late 2024, it's now commercializing mass-produced, cost-efficient L4 robotaxis and expanding globally into the Middle East and Europe.

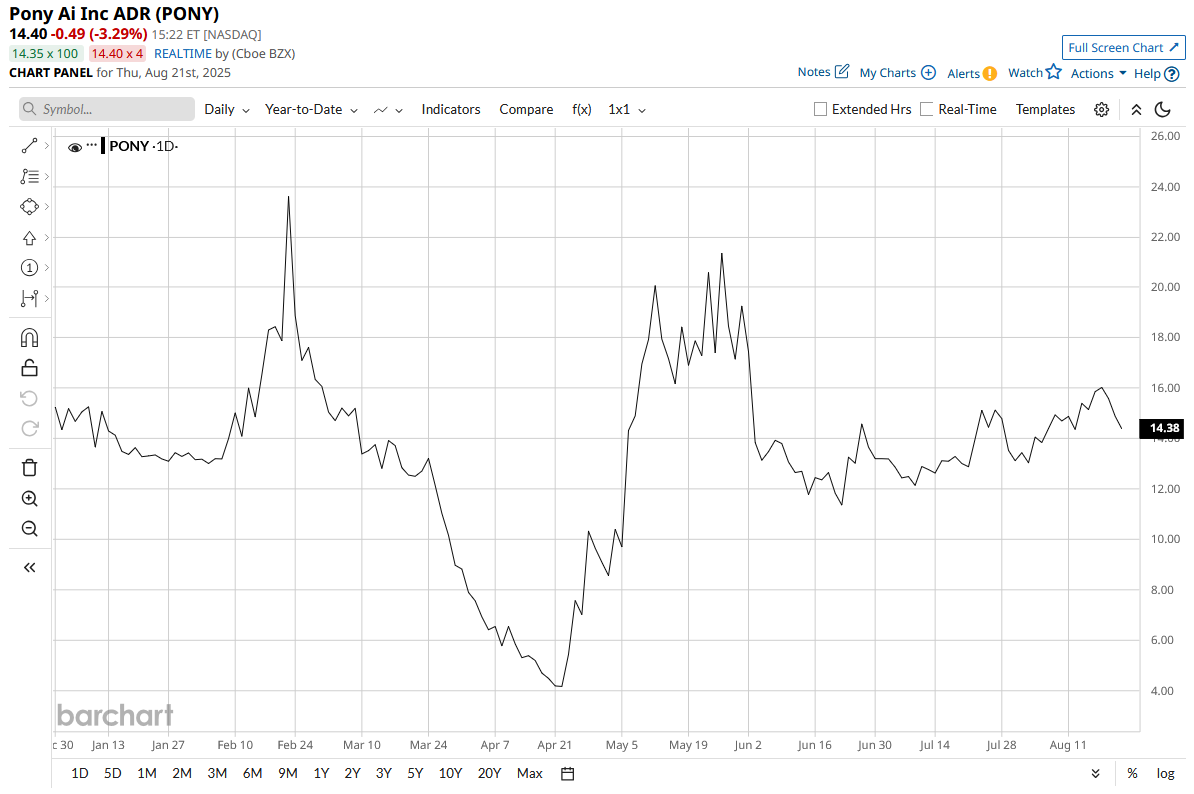

Valued at a market cap of $5.2 billion, PONY stock is up a mere 0.15% on a year-to-date (YTD) basis.

PONY's Quarterly Results

Pony's results for the most recent quarter exceeded Street expectations, with the company's losses coming in narrower than expected, while revenues also went up from the previous year. Revenues for the quarter came in at $21.46 million, up 76% on a YOY basis, with revenues from the robotaxi business more than doubling to $1.53 million from $592,000 in the year-ago period. Although the company is yet to be profitable, it narrowed its losses considerably to $0.14 per share from $0.92 per share in the same period a year ago.

Concerns around net cash outflow from operating activities continued to persist, as the same increased to $25.4 million from about $18 million in the previous year. Overall, the company closed the quarter with a cash balance of $318.7 million, which was much higher than its short-term debt levels of just $4.33 million.

PONY's Strengths and Weaknesses

Notably, Pony’s key strength lies in its own in-house, fully integrated self-driving platform, called “Generation 7.” It’s designed for Level 4 autonomy, uses parts built to automotive-grade standards, and has managed to cut production costs by close to 70%. That mix of reliability and cost control gives the company a solid edge as it looks ahead.

Moreover, at present, Pony is working with leading Chinese automakers such as Guangzhou Automobile Group and Beijing Automotive Industry Corporation to roll out robotaxi fleets powered by Generation 7. The company aims to have about 1,000 of these vehicles running in major Chinese cities by 2025. Outside of China, it’s also moving forward. In May, Pony announced a partnership with Uber (UBER) to make its autonomous robotaxis available through Uber’s app. This could open up new markets and help the company get more real-world miles under its belt.

However, Pony's path to profitability remains one for the long haul, as its heavy spending on R&D hurts the capacity to generate profits and free cash flow. Further, the U.S. operations of the company remain limited and the current administration's apathy towards China (at least for the time being) further dents the prospects of the company in the world's second-largest EV market.

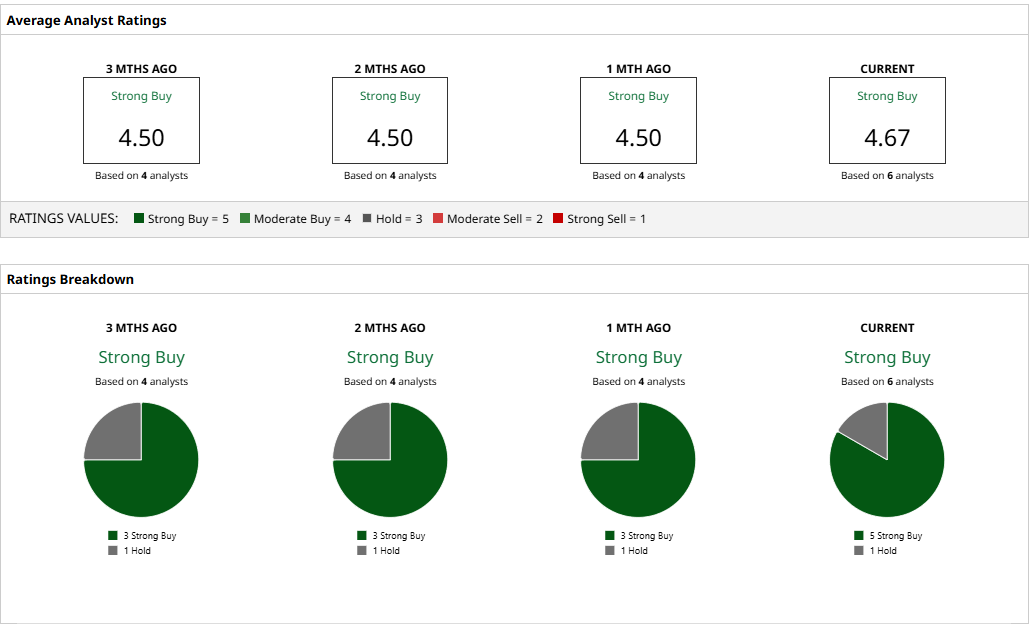

Analysts on PONY

Overall, analysts have attributed a rating of “Strong Buy” for the stock, with a mean target price of $21.50. This denotes an upside potential of about 49% from current levels. Out of six analysts covering the stock, five have a “Strong Buy” rating, and one has a “Hold” rating.

Tesla (TSLA)

Founded in 2003, Tesla designs, develops, manufactures, and sells EVs, energy generation/storage systems (like Powerwall and Megapack), and autonomous driving technologies. Current CEO Musk became one of the early backers of the company, which was founded by engineers Martin Eberhard and Marc Tarpenning.

Valued at a market cap of $1 trillion, the TSLA stock is down 20% on a YTD basis.

Tesla's Quarterly Results

Meanwhile, after reporting two consecutive quarters of earnings misses, Tesla's bottom line finally came in line with expectations in Q2 2025. Tesla posted earnings per share of $0.40 for the quarter, reflecting a 23% decline from the same period last year. Quarterly revenue stood at $22.5 billion, marking a 12% year-on-year decrease. The company’s core automotive business experienced a sharper contraction, with revenue down 16% to $16.7 billion, as intensifying competition and the political activities of CEO Elon Musk continued to weigh on demand. The energy division recorded a comparatively smaller drop of 7%, bringing in $2.8 billion.

Vehicle production for the quarter totaled 410,244 units, marginally below the 410,831 units recorded a year earlier. Deliveries fell more steeply, decreasing 13% to 384,122 units, which was slightly under the 387,000 consensus estimate reported by FactSet.

Despite the weaker top and bottom-line results, Tesla remained cash-flow positive. However, cash generation contracted alongside revenue and earnings. Net cash provided by operating activities amounted to $2.5 billion, a 30% decline from the prior year, while free cash flow dropped sharply to $146 million, representing an 89% decrease. The company ended the quarter with a cash position of $36.8 billion, up 20%, substantially exceeding its short-term debt obligations of $15.2 billion.

Tesla's Strengths and Weaknesses

Since my last analysis on Tesla, the company has abandoned its Dojo Supercomputer division. Aiming to streamline its efforts, this action by the company is expected to bode well for it, with focus shifting back towards the core automotive business. This also appears to be a timely development amid Musk's ambitious autonomous mobility plans and increased competition from both home and abroad.

Notably, Tesla has established the world’s first vision-driven, fully integrated autonomous mobility network that operates through consumer-owned vehicles. With a software architecture developed entirely in-house, from custom silicon design to the inference engine, the company maintains direct control over its cost structure and scalability in a way unmatched by competitors. Austin has emerged as the initial hub of this network, with expansion plans targeting Houston, Miami, Los Angeles, and Phoenix. Unlike other participants in the autonomous driving sector, Tesla already benefits from a vast installed base of millions of vehicles and an extensive repository of billions of miles of real-world driving data.

However, Tesla’s ambitions extend well beyond the robotaxi segment, a factor that gives it an advantage over companies like Pony. The company’s humanoid robot program, Optimus, is now in its third generation and undergoing active trials within Tesla’s manufacturing facilities. The firm’s competitive edge lies not only in its vertically integrated operational model but also in its advanced artificial intelligence software stack, which continues to improve by training across diverse real-world conditions.

Tesla’s energy division is also performing strongly, with record Powerwall installations achieved in the second quarter, robust demand for Megapack units, and a notable improvement in margins. Looking ahead to 2026, the company expects to bring its new Megapack manufacturing facility in Houston online, alongside the launch of its first lithium iron phosphate battery plant.

However, apart from the heightened competitive intensity, the removal of the $7,500 tax credit comes as a significant blow for Tesla, more so when its vehicle sales are seeing a decline. Further, Musk's political adventures can hurt Tesla more than they can benefit. Thus, investors should be wary of the same.

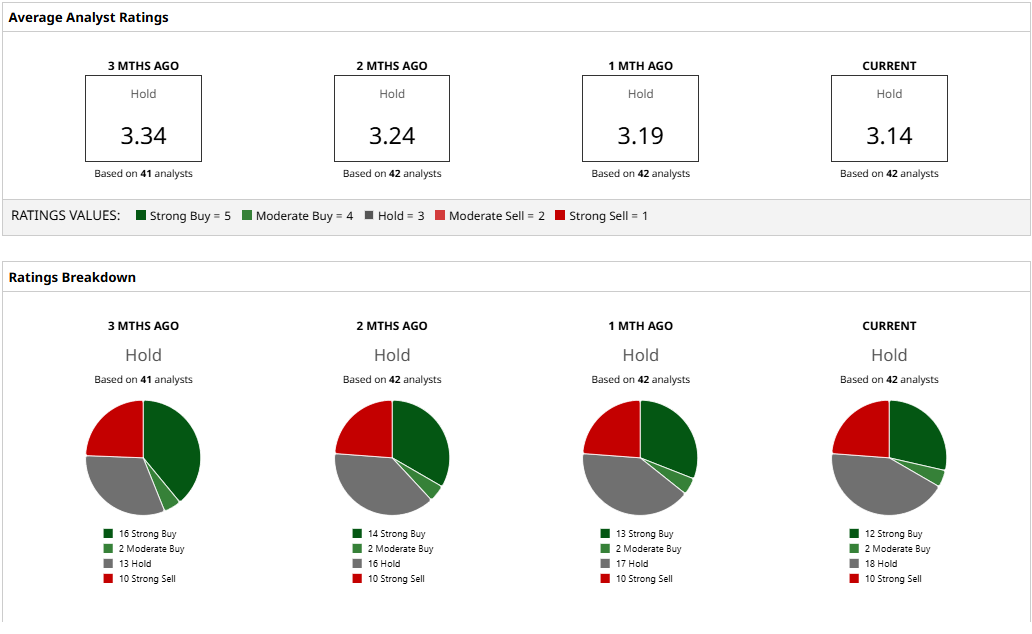

Analysts on TSLA

Taking all of this into account, analysts have deemed the TSLA stock a “Hold,” with a mean target price of $299.28, which has already been surpassed. However, the high target price of $500 denotes upside potential of about 55% from current levels.

Out of 42 analysts covering the stock, 12 have a “Strong Buy” rating, two have a “Moderate Buy” rating, 18 have a “Hold” rating, and 10 have a “Strong Sell” rating.

Final Take

Pony may be a serious competitor to Tesla in the future, at least in the robotaxi division, with the company chugging along with innovative developments and forging critical partnerships with established names in the sector.

However, Tesla, for its sheer size, scale, availability of resources, and global brand value, is currently way ahead of Pony, with significant headroom for growth available for both. Yet, Tesla seems to be better position to capture this growth opportunity now.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.