- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

A $10 Billion Reason to Buy Palantir Stock

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Palantir Technologies (PLTR) is a leading software company that focuses on helping organizations make sense of large and complex data. Its platforms use advanced analytics and artificial intelligence to integrate various types of data, enabling customers, including government agencies and businesses in industries such as finance, healthcare, and energy, to gain simplified insights that facilitate better decision-making.

Founded in 2003, the company is headquartered in Denver, Colorado.

About Palantir Stock

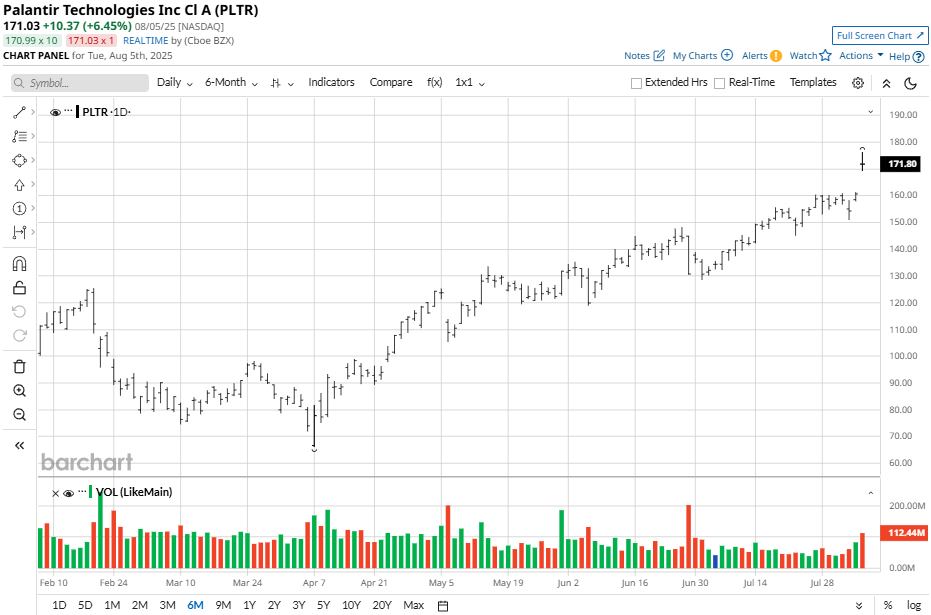

Palantir’s stock has been one of the standout performers in 2025, gaining more than 147% YTD, easily outpacing the benchmark S&P 500 Index’s ($SPX) more modest 8.7% jump. The stock trades at its 52-week and all-time highs, having achieved nearly 550% growth over the past year. Moreover, it continues its rally with a 21.5% gain in five days and a 34% gain in a month.

Palantir Posts Q2 Results

Palantir posted its second-quarter results on Monday, Aug. 4. It reported adjusted earnings of $0.16 per share, beating analysts’ $0.14 per share estimate, a significant 77% rise from the same quarter last year. The company also posted a record revenue figure, which stood at $1 billion, marking a 48% rise while surpassing estimates of $939 million. Palantir’s U.S. commercial revenue jumped 93% to $306 million while U.S. government revenue rose 53% to $426 million.

Beyond headline numbers, Palantir strengthened its financial position with record contract momentum: 157 contracts worth at least $1 million, 66 contracts worth at least $5 million, and 42 contracts of $10 million or more in Q2. Adjusted operating income hit $464 million, boosted by margin expansion to 46%, continuing an upward trend quarter-over-quarter.

It had a free cash flow of $569 million with a 57% margin while cash reserves stood at $6 billion with zero debt.

Looking ahead, Palantir raised its full-year 2025 revenue guidance to $4.142 billion to $4.15 billion, up from the previous forecast of $3.89 billion to $3.9 billion. The company also expects ongoing contract wins and growth in both government and commercial sectors, fueled by accelerating adoption of its Artificial Intelligence Platform and a recent multibillion-dollar U.S. Army contract.

Palantir Wins U.S. Army Deal

Palantir Technologies has secured a landmark contract with the U.S. Army valued at up to $10 billion over the next decade, marking the largest Department of Defense deal ever awarded to the company. The contract is a new enterprise agreement, which consolidates 75 existing contracts, including 15 prime contracts and 60 related ones, into a single streamlined contract intended to enhance military readiness and boost operational efficiency.

The consolidation reduces procurement timelines, allowing soldiers quicker access to Palantir’s advanced data integration, analytics, and AI tools. The deal also establishes volume-based discounts and provides the Army and other Department of Defense (DoD) entities flexibility to purchase Palantir’s commercial products as needed, though total spending will not exceed the $10 billion cap.

This contract significantly strengthens Palantir’s role as a key technology provider for the military, while also driving cost savings and procurement simplification for the Army.

Should You Buy Palantir?

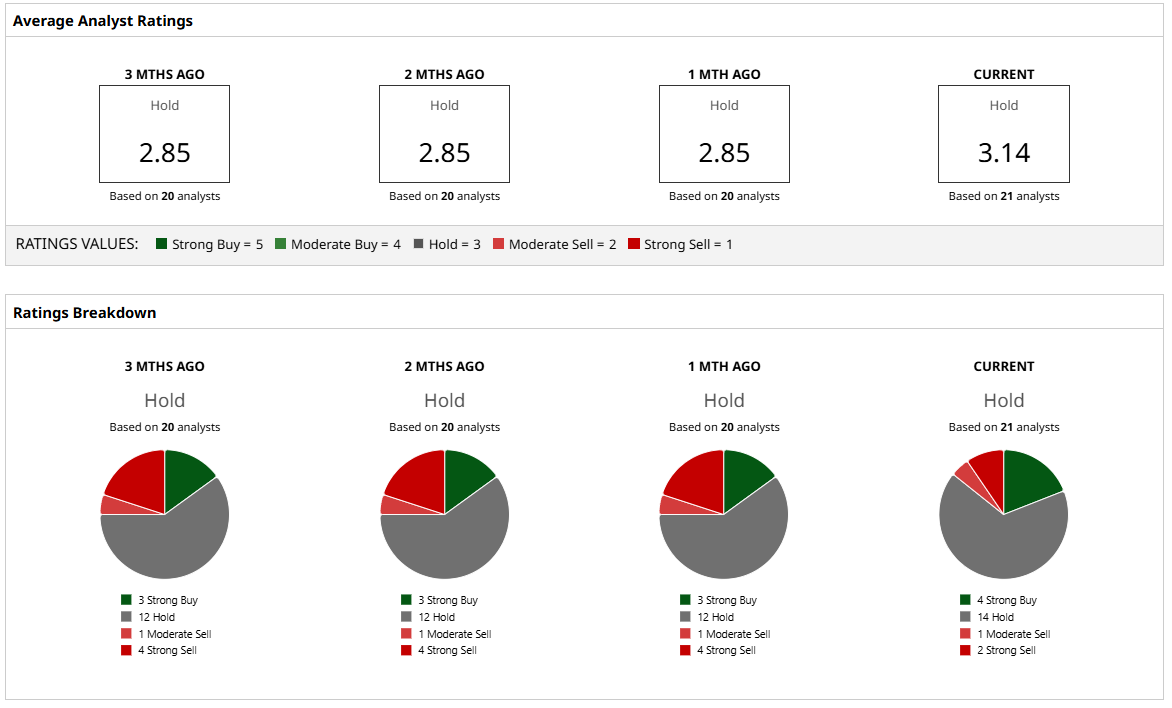

The stock has a consensus “Hold” rating with a mean price target of $147.50 which is well below its trading price, but it is worth noting that Palantir trades at an all-time high with strong momentum that has analysts playing catch up with its performance.

It has been rated by 21 analysts with four “Strong Buy” ratings, 14 “Hold” ratings, one “Moderate Sell” rating, and two “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.