- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Analysts Love This AI Data Center Stock

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

Vertiv (VRT) is a global leader in critical digital infrastructure, specializing in power, cooling, and information technology management solutions for data centers, communication networks, and commercial and industrial environments. It delivers end-to-end, rapidly deployable solutions, including thermal management, power distribution, integrated racks, and monitoring software, to ensure the stable performance of digital ecosystems.

The company operates in more than 130 countries and is headquartered in Ohio.

About Vertiv Stock

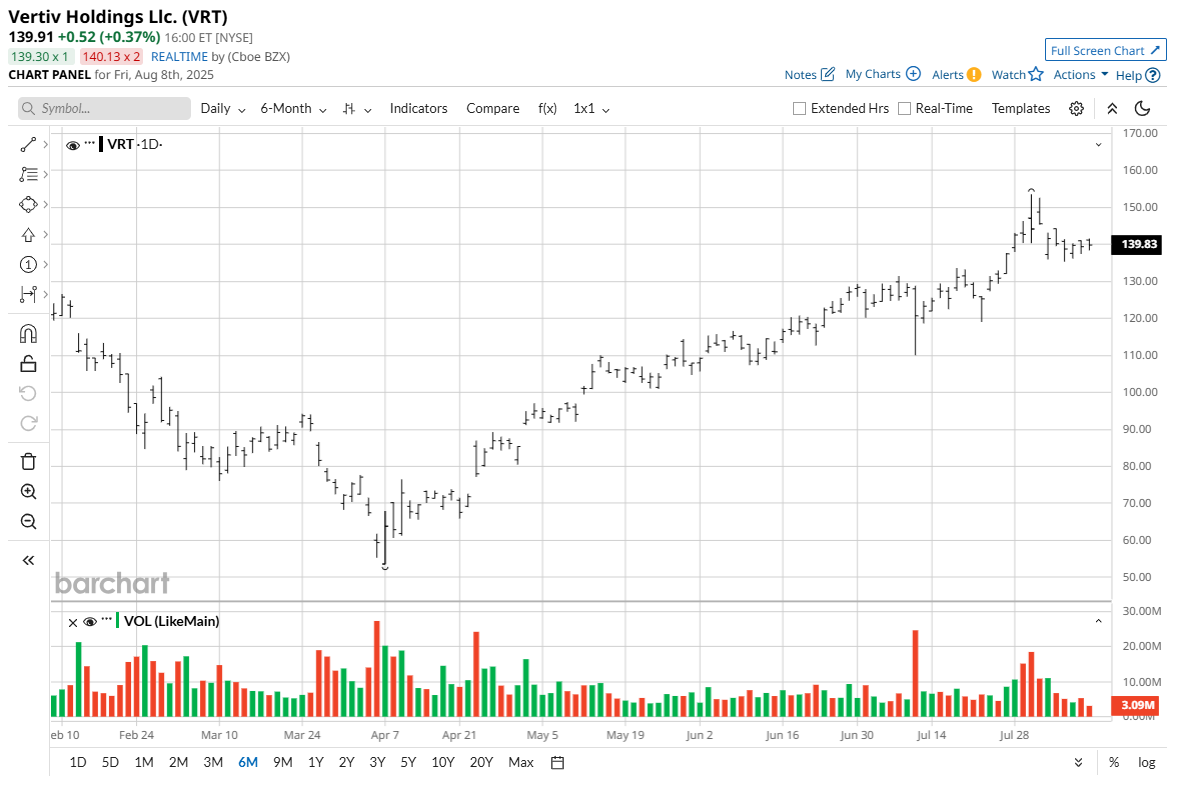

Vertiv Holdings has delivered standout stock performance in 2025, up 23% in 2025, significantly outpacing the S&P 500 Index’s ($SPX) 8.7% gain during the same timeframe. Over the past 12 months, Vertiv stock surged nearly 97%, significantly outperforming the S&P 500’s 20% growth. Notably, a major portion of Vertiv’s gains occurred after April, with shares up 46% over the past three months.

Fresh Analyst Rating on Vertiv

Vertiv Holdings was recently rated “Outperform” by William Blair analysts, citing its pivotal role in meeting surging demand for artificial intelligence-driven data center infrastructure. The expanding adoption of generative AI, cloud software, and high-performance computing is driving a projected annual increase in data center capacity of 13-20 GW through 2030, leading to a potential 100 GW in new capacity.

Vertiv, specializing in high-density, prefabricated power, and cooling systems suited for GPU workloads, is seen as well-positioned to benefit. Roughly 80% of its revenue is derived from the data center industry, and the company boasts strong relationships with leading chipmakers, hyperscalers, and colocation providers.

William Blair estimates that each additional megawatt of deployed data center capacity generates $2.75 million to $3.5 million in Vertiv revenue. The company’s backlog covers at least 78% of expected revenue over the next 12 months, providing strong forward visibility.

Vertiv Posts Stellar Results

Vertiv Holdings reported stellar Q2 2025 results on July 30, exceeding analyst expectations on both earnings and revenue. The company posted non-GAAP earnings of $0.95 per share, a 42% increase year over year. Revenue surged 35% to $2.64 billion, also beating analyst projections by nearly 12%. This compares to $1.95 billion in the same period last year, marking a significant acceleration in business momentum.

Product revenues, which comprise 82.1% of the total, grew 39.3% year over year, while service revenues rose 18.7%. The backlog stood at $8.5 billion, up 21% from 2024’s end, reflecting robust demand and strong visibility for future sales.

Vertiv saw adjusted operating profit climb 28% to $489 million, with a non-GAAP operating margin of 18.5%. Free cash flow for the quarter was $277 million, and end-of-quarter cash, cash equivalents, and marketable securities totaled $1.64 billion.

For the remainder of 2025, Vertiv raised its guidance. It now expects full-year revenues of $9.925 billion to $10.075 billion, adjusted EPS between $3.75-$3.85, and free cash flow between $1.375 billion and $1.425 billion.

The company anticipates operating margins in the 19.7%-20.3% range, demonstrating confidence that data center demand will remain high.

Should You Buy VRT Stock Here?

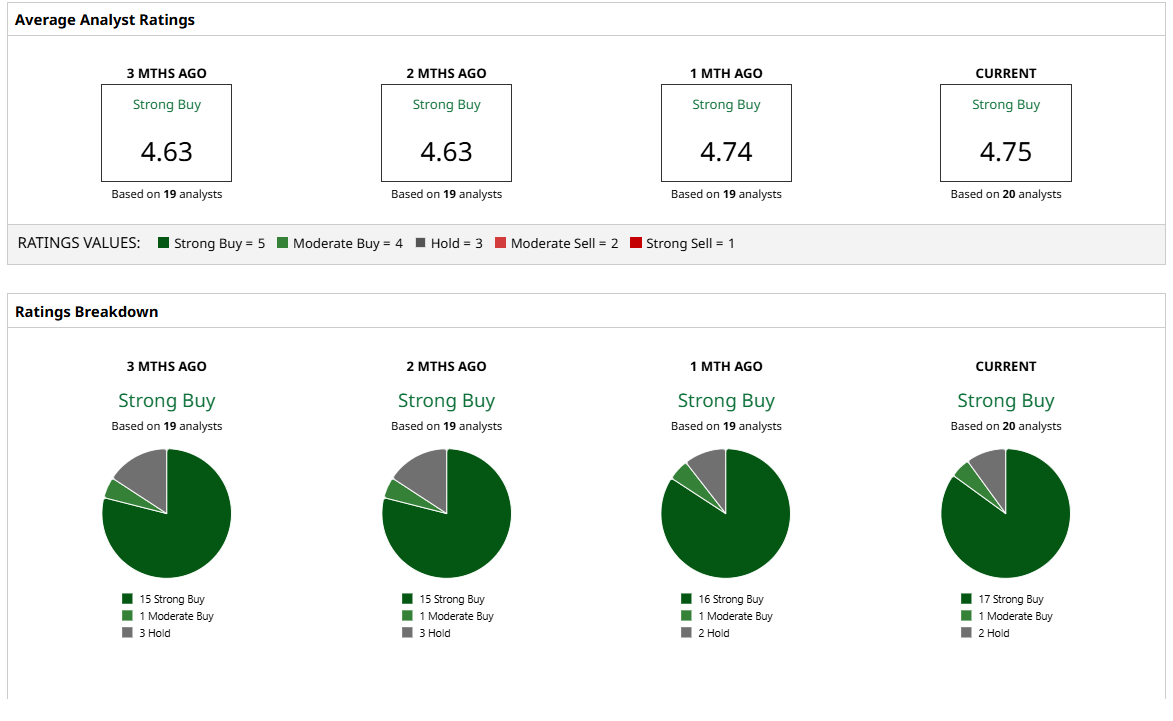

Vertiv Holdings has garnered strong support on Wall Street with a consensus “Strong Buy” rating, but the stock's mean price target of $154 leaves just 11% in upside potential. It has been rated by 20 analysts with 17 providing a “Strong Buy” rating, one “Moderate Buy” rating, and two “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.