- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

1 ‘Strong Buy’ Defense Stock to Snag Instead of Palantir

While Palantir (PLTR) continues to trade at premium valuations, savvy investors should consider AeroVironment (AVAV), a defense technology powerhouse trading at significantly lower earnings multiples despite comparable growth prospects. AeroVironment develops defense technology and cyber operations at a much more attractive valuation than Palantir, making AVAV stock more attractive for value-conscious investors.

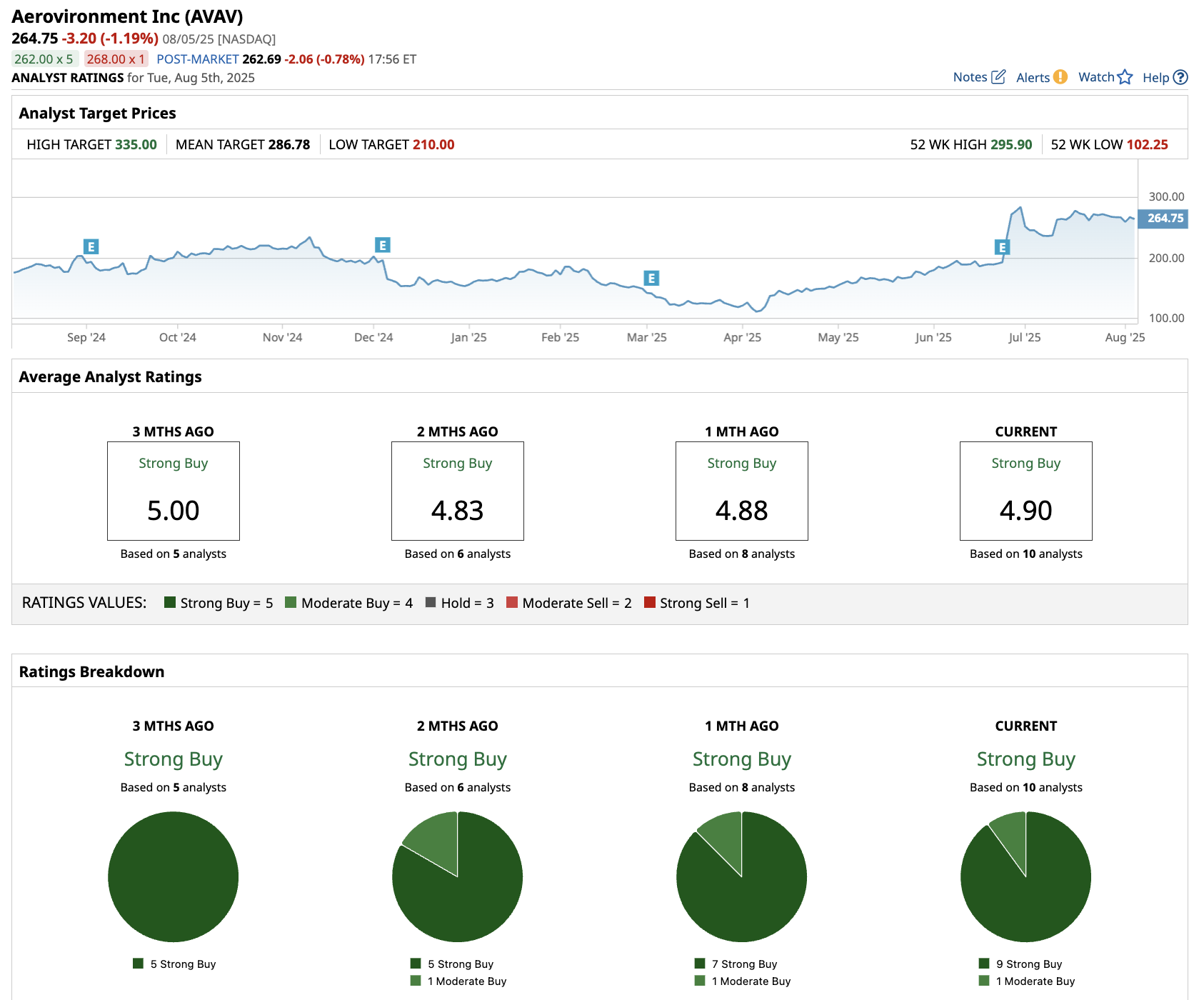

Citizens Bank recently initiated coverage on AVAV stock with an “Outperform” rating and a price target of $325, recognizing the company’s leadership position across multiple defense domains.

The $4.1 billion BlueHalo acquisition has transformed AeroVironment into a diversified defense technology leader spanning air, land, sea, space, and cyber domains. This strategic acquisition reduces concentration risk as no single mission area is expected to contribute more than 30% of fiscal 2026 revenue.

With over 50 years of proven battlefield experience and nearly $2 billion invested in research and development over the past decade, AeroVironment delivers software-defined hardware solutions, including Switchblade loitering munitions, unmanned aircraft systems, and cybersecurity platforms.

The expansion of the U.S defense budget, which includes $25 billion for missile-defense systems and $13.4 billion for autonomous platforms, directly benefits AeroVironment’s core competencies. AVAV stock is well-positioned to capitalize on the U.S. government’s shift toward next-generation defense technologies.

How Did AeroVironment Stock Perform in Fiscal 2025?

In Q4 of its fiscal 2025 (ended in April), AeroVironment reported revenue of $275 million, an increase of 40% year over year. The company ended fiscal 2025 with revenue of $821 million, indicating organic growth of 14% despite lower Ukraine-related sales.

AeroVironment secured $1.2 billion in total bookings and reported a backlog of $726 million, up 82% year over year. Notably, its Loitering Munition Systems segment generated $352 million in annual revenue, an 83% increase, driven by strong Switchblade demand from both domestic and international customers.

AeroVironment’s innovation engine produced three groundbreaking products during fiscal 2025, which include the AI-driven P550 autonomous UAS, the JUMP-20X vertical takeoff maritime system, and the Red Dragon one-way attack drone.

These solutions directly address critical military priorities and position AVAV stock for future revenue generation, with management expecting these platforms to generate hundreds of millions in backlog over the next two to three years.

International expansion continues to accelerate, with 52% of total sales now coming from global customers across 100 allied nations. Eight countries have placed Switchblade orders totaling $250 million in fiscal 2025, while another eight allies are actively engaged in the foreign military sales process.

AeroVironment’s ambitious fiscal 2026 guidance of $1.9 billion to $2 billion in revenue reflects the transformative impact of the BlueHalo integration and strong underlying demand. The company restructured into two segments: Autonomous Systems (expected $1.2 billion to $1.4 billion revenue) and Space, Cyber & Directed Energy ($700 million to $900 million revenue), with both targeting double-digit growth.

Management’s 70% visibility into the midpoint guidance, higher than historical ranges, underscores confidence in the company’s growth trajectory and positioning within favorable defense spending cycles.

Is AVAV Stock Still Undervalued?

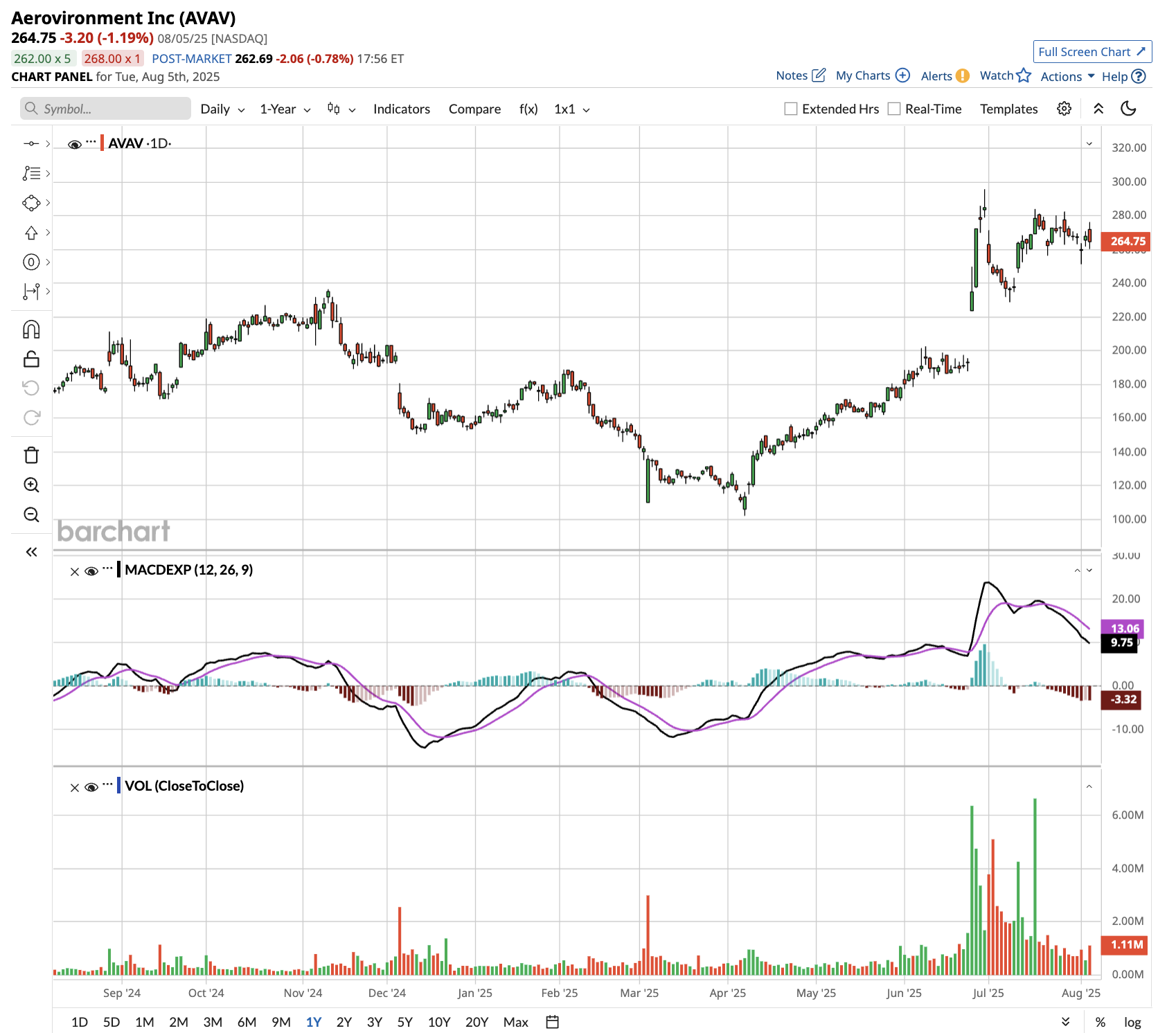

AVAV stock has returned close to 1,000% to shareholders over the past decade, valuing the company at a market cap of $12.8 billion. Wall Street estimates revenue to grow from $820.6 million in fiscal 2025 to $3.5 billion in fiscal 2030. Comparatively, adjusted earnings are forecast to expand from $3.28 per share to $9.60 per share in this period.

Today, AVAV stock trades at a forward price-earnings multiple of 75x, above its five-year historical average of 54x. If the tech stock is priced at 40x forward earnings, it should trade around $384 in August 2029, indicating upside potential of 45% from current levels.

AVAV stock offers a superior value proposition compared to Palantir, combining strong growth prospects, diversified revenue streams, and reasonable valuations in an increasingly favorable defense spending environment.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.